Oh! what a tangled web we weave

When first we practice to deceive!

Our investigation into Cell Therapeutics, Inc.'s (NASDAQ: CTIC) business, management and board raises serious and troubling issues. CTIC has operated at an enormous loss for the entirety of its twenty year existence, while paying insiders tens of millions of dollars and harshly diluting its investors with toxic hedge fund deals along the way. In its lifetime, CTIC has raised over $1.4 billion from the public markets, yet its market capitalization today is less than ten percent of that, approximately $130 million. This year alone, shares of CTIC stock are down over 75%, after giving effect to a 1:5 reverse split, which was required to avoid being delisted by the NASDAQ and relegated to the OTC-Bulletin Board or pink sheets.

The United States Department of Justice has sued CTIC for an elaborate and illegal scam to market its drugs without FDA approval. The company chairman's academic credentials are fake, its chief executive officer has an undisclosed criminal arrest, and the company has no chief financial officer, though the chief executive officer's brother has maintained the books for twenty years. Alarmingly, CTIC sought out and continues to use an auditor that the Public Accounting Oversight Board (PCAOB) inspected and found to have "audit deficiencies … of such significance that … [the firm] did not obtain sufficient competent evidential matter to support its opinion on the issuer's financial statements."

The story of CTIC includes a private jet funded at investors' expense, a defaulted multi-million dollar loan to the chief executive officer put in place months before Congress made doing so illegal, and a successful lawsuit against the directors and officers of the company for breaching their fiduciary duties to shareholders. Another successful lawsuit accused the company of making false and misleading statements to induce investors to buy CTIC stock.

Rat Poison: A Cancer "Treatment as Individual as You Are"

All this is cloaked in the veil of a company that purports to make cancer "treatments as individual as you are," and has no compunction about playing the "cancer card" to, as TheStreet.com said, borrow "a page from the Jerry Lewis telethon playbook" when it comes to convincing shareholders to approve management proposals. But CTIC actually perpetuated a fraud on doctors treating patients with cancer to induce them to prescribe its drugs, which were neither FDA approved nor medically accepted. The Department of Justice explains how in its lawsuit against the company:

This case involves a scheme by defendant Cell Therapeutics, Inc. to market and promote its drug Trisenox, a form of the common household poison arsenic, for the off-label treatment of various forms of cancer, when [CTIC] knew that the use of the drug for such cancers was not medically accepted, and had not been found by the Food and Drug Administration to be safe and effective.

In the course of its off-label marketing scheme, [CTIC] made false and misleading statements to treating doctors to effect that Trisenox was medically accepted for the off-label uses being promoted, and therefore eligible for Medicare reimbursement. In reliance on [CTIC's] false statements, treating physicians mistakenly administered Trisenox to their patients. [CTIC] thus caused physicians to present false claims for payment to Medicare. Furthermore, [CTIC] also caused a series of separate false statements to be made to medical directors working for Medicare program carriers to try to obtain Medicare reimbursement for off-label uses of Trisenox, when [CTIC] knew that Trisenox had not been found to be safe and effective by the FDA, and was not medically accepted for such uses. …

In conjunction with its off-label marketing scheme, [CTIC] provided doctors and others with money, free travel, food and entertainment, grants, and other valuable goods and services, with the intent to induce physicians to prescribe Trisenox for unapproved indications. This conduct violated the Medicare-Medicaid Anti-Kickback Act.

Finally, [CTIC] paid thousands of dollars to treating physicians ostensibly to conduct "research" on the off-label uses of Trisenox, although such payments were unconnected with [CTIC's] actual research department.

[CTIC's] illegal scheme to promote the prescription of Trisenox for indications which were neither FDA approved nor medically accepted, greatly increased Trisenox sales to the financial benefit of [CTIC] but caused the Medicare Program to pay millions of dollars for the administration of a drug with no proven medical value to thousands of persons who were dying of cancer.

CTIC has quietly agreed to repay Medicare over $10,000,000 for the fraudulent reimbursements it induced.

No Cure for Chronic PIPE Syndrome

CTIC's stock price decline can be traced to the terms of a recent financing. An examination of the deal reveals the "you scratch my back and I'll scratch yours" relationship between CTIC and a hedge fund known as Socius Capital. Over the summer, CTIC announced a private placement deal, known on Wall Street as a "PIPE", which was structured as a riskless transaction for Socius Capital, the principals of which are a convicted criminal and legendary stock promoter.

The offering consisted of $40,000,000 of preferred stock, convertible to 40,000,000 shares of common stock, and over 25,000,000 5-year warrants to purchase shares of the company, according to company filings.

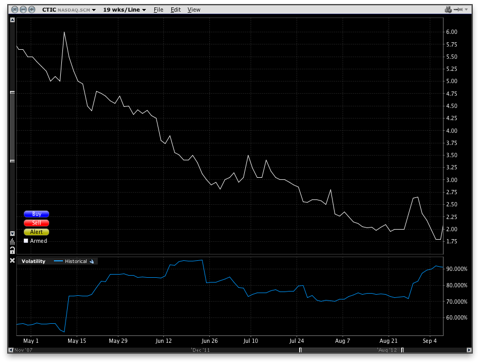

While this deal may have appeared benign, there was a toxic feature in the warrants' fine print. According to the warrant agreement, in section 5, if any of the warrants are out-of-the-money, meaning CTIC's market price is below the exercise price of the warrant, Socius Capital can exchange the warrants for shares of common stock or cash, equal to the "Black-Scholes Exchange Value" of the warrant. The formula for the "Black-Scholes Exchange Value" was made up for this deal, and rigged to make sure that the warrants are always worth a lot of money. The formula, buried in section 17(b), uses an expected volatility of 135%, more than double any reasonable estimate at the time as illustrated below, and a time value of five years, regardless of the actual time to expiration.

Putting substance over form, CTIC and Socius Capital gave the market the impression that they had priced a good deal near the market price of the stock at the time, but in reality Socius Capital's cost basis was much lower. If CTIC's stock went up, Socius Capital made money from the appreciation of the value of the warrant, and if CTIC's stock price went down, CTIC would send more shares or simply wire money back to Socius Capital.

Allowing the warrant to be exchangeable for stock or cash virtually guaranteed Socius Capital would make money, always at the expense of CTIC and its common stock investors. The PIPE deal, by its design, put significant downward pressure on the stock, so much pressure that the company had to effect a 1:5 reverse split to regain compliance with NASDAQ's minimum bid price rule.

What the PIPE Deal Means for Investors

The warrant exchange provision in the PIPE deal guaranteed Socius Capital half of its total cash outlay back the moment the deal closed. In other words, the CTIC board authorized a deal to sell 40,000,000 shares of CTIC at a 50% discount to the market price. The 50% drop between June and August, as well as abnormally high trading volume during that period, seem to suggest that this is exactly what happened. It is unlikely that a healthy company would accept such a desperate financing structure.

The company telegraphed in its recent 10-Q that there may be more such deals to come: "We may need substantial additional capital to fund our current operations, particularly in light of the cash needed to fund development of our drug candidates. … We may not be able to raise such capital or, if we can, it may not be on favorable terms. We may seek to raise additional capital through public or private equity financings..." A summary of CTIC's prolific deal history appears at the end of this article.

Inmate Number 43259-054

The criminal mind behind this creative structure is that of Socius Capital principal Michael S. Wachs. Mr. Wachs is a criminal who has been convicted of bank fraud in U.S. District Court. Federal judge John G. Koeltl ordered Mr. Wachs "committed to the custody of the U.S. Bureau of Prisons to be imprisoned for a total term of 16 months." The judge recommended that Mr. Wachs "receive psychological counseling for his gambling addiction," and ordered that "upon release from imprisonment, [Mr. Wachs] shall be on supervised release for a term of 3 years." Judge Koeltl also ordered that Mr. Wachs "shall not possess a firearm." In addition, Mr. Wachs was ordered to "further amend his taxes, as applicable, to reflect [sic] the additional income derived from his crimes and comply with all U.S. Internal Revenue Service [sic] directives." Mr. Wachs' Federal prison inmate number was 43259-054, according to a U.S. Department of Justice database.

In addition, according to a notice published by the Financial Industry Regulatory Authority (FINRA), Mr. Wachs has also been "censured, fined $250,000, barred from association with any [FINRA] member in any capacity and required to make full restitution to his member firm." The notice states that Mr. Wachs did not deny having "misappropriated $20,800,000 in proceeds by means of false and fraudulent pretenses, representations, and promises for the sale of certain of his member firm's assets and then diverted the proceeds to himself and others."

Finally, Mr. Wachs is the subject of an Order of Prohibition by the Federal Reserve that bans him from being involved with a banking institution after, according to a Fed press release, he allegedly engaged "in a fraudulent scheme to purchase Chase Manhattan Corporation assets by means of a fraudulent bidding process and to obtain a profit from the immediate resale of those assets."

A "Revolutionary or a Snake Oil Salesman"?

Mike Wachs’ partner at Socius Capital is Terren Peizer, who holds the titles Chairman and Managing Director, according to a Business Week executive profile. CBS' 60 Minutes describes him as a "steely eyed financier, a former bond salesman" who "worked for, then testified against, Michael Milken, infamous in the junk bond scandal of the 1980's."

Mr. Wachs is experienced in executing Wall Street "pump and dump" schemes where promoters purchase stock, make statements to make the price go up (the "pump"), and subsequently sell their shares at inflated values (the "dump").

The beginning stage of one such scheme was covered in the pages of the New York Times. Hollis-Eden Pharmaceuticals, Inc., turned heads on Wall Street with its unexplained bull run, prompting the story, "No Sales, But Watch the Stock Soar":

Wall Street's Terren Peizer is like Woody Allen's Zelig: he shows up in some of the oddest places. … Now Mr. Peizer has turned up as the president of Hollis-Eden Pharmaceuticals, Inc., a fledgling drug company with a stock that has soared 170 percent this year.... While biotechnology stocks have been making something of a comeback lately, the Nasdaq index of these shares, which includes Hollis-Eden, has risen just 5.7 percent this year.

While Hollis-Eden's market value, $112 million, might seem big for a company with no sales, much less earnings, Mr. Peizer is passionate about the prospects for its anti-AIDS drugs, and he is a persuasive salesman. ''This is a once in a lifetime opportunity for me,'' he said last week. ''We have something special.''

Unlike many biotechnology companies, Hollis-Eden has not been vetted by a big brokerage firm that wants to take it public or a big pharmaceutical company that wants to be its partner...

As for the run-up in the stock price, [Mr. Peizer] said, ''I don't understand the ways this happens.'' Company officials say they are not behind the rise; despite the press release, they have been trying to keep a low profile, they say, and they do not think a brokerage firm is pushing the stock. Indeed, no analysts now cover the company...

Despite telling the New York Times, "I would throw myself on the tracks if it would help this company," one year later, Mr. Peizer and Hollis-Eden had entered into a "Separation and Mutual Release Agreement" according to regulatory filings. The stock subsequently plunged 50% from nearly $20 to $10, and now trades for less than $0.25 under the name Harbor Biosciences.

60 Minutes covered another of Mr. Peizer's companies, called Hythiam, which sold a drug named "Prometa," Greek for "positive change," that was a "cure" for drug addicts and alcoholics. CBS reported:

Word is spreading fast about a new therapy that is said to break the grip of drug addiction in a simple treatment. Addicts who have tried everything and remained hopelessly hooked say their drug cravings ended almost overnight. The therapy is called "Prometa." As correspondent Scott Pelley reports, it's being promoted by Terren Peizer, a former junk bond salesman whose business is business, not medicine.

CBS skeptically noted that Mr. Peizer "skipped the usual medical research and government approvals to rush Prometa to market" because, he told them, "there's no way he can sit on Prometa when he believes it's the miracle treatment that millions are dying for." Perhaps not literally.

Before buying what Mr. Peizer was selling, CBS interviewed Dr. John Mendelson, a professor at UCSF and senior scientist at the Addiction Pharmacology Lab at the California Pacific Medical Center who studies the development of treatments for drug abuse and associated medical and psychiatric complications. Dr. Mendelson told CBS, "They're just saying this stuff works without actually subjecting it to the proper kinds of trials," and that the science doesn't match Prometa's promotion. Further, Dr. Mendelson said that none of the drugs used in Prometa seem to affect addiction. He noted that Mr. Peizer is "spending money to recruit the treaters and to recruit the insurance payers but not to prove that the treatment works."

The 60 Minutes report went on to expose that Mr. Peizer had intentionally avoided the Food and Drug Administration (FDA) drug approval process, and brazenly exploited a loophole in the law that allowed to be marketed anyway. Dr. Mendelson said, "It is shocking. It is shocking. I, to be honest with you, I've never seen anyone actually try it. And this is one of those loopholes that may exist because no one has had the chutzpah to go out and actually try it. But up 'til now."

Anchor Scott Pelley clairvoyantly told Peizer, "Depending and who you talk to, you're either a revolutionary or a snake oil salesman." In late 2007, before the financial crisis, the company's market cap tumbled from $385 million to finish around $150 million. And in 2008, Hythiam's revenue declined substantially. Hythiam has since fallen into the abyss, changing its OTC Bulletin Board ticker symbol to "CATS" and re-naming itself "Catasys, Inc." to " better reflect the focus of the company in providing health insurers and other payors with a comprehensive behavioral health management solution." The company is currently valued at less than $10 million.

Unlike a fundamental investor who wants to hold his position for a long time and minimize dilution, PIPE investors like Socius make money from the dilution. A criminal can't change his pinstripes. Mike Wachs and Terrence Peizer's involvement with CTIC suggests it is just like Hollis-Eden and Hythiam: a "pump and dump". If CTIC had something real, experienced biotechnology funds would be financing the company.

One Company's Trash is CTIC's Promotion Tool

CTIC's management has been banking on stock market optimism to allow the company to raise capital. CTIC's history shows that it acquires compounds that have been abandoned by other pharmaceutical companies, but have the allure of potentially being worth billions of dollars, thus creating more market optimism.

In 1998, CTIC used the proceeds from its initial public offering to acquire the lung cancer treatment drug OPAXIO. While the drug may have had some potential at one point, in 2005 the company announced that OPAXIO had missed its primary endpoints for superior overall survival, and it began a new trial with slightly different parameters hoping to get a different result. In 2006, this trail was shut down by the Data Safety Monitoring Board. CTIC initiated a new trial in 2007, and even though the FDA has a well established requirement that two pivotal, statistically significant studies at a minimum would be required for their drug to be approved, CTIC management believed that one trial, with supporting evidence from CTIC's previous failed trials, would be enough. In 2010, the company lost its optimism for the drug's potential to treat lung cancer, writing, "In September 2009, we notified the [European Medicines Agency] of our decision to withdraw the [Marketing Authorization Application] and we refocused our resources on the development of OPAXIO for its potential superiority indication in maintenance therapy for ovarian cancer and as a radiation sensitizer in the treatment of esophageal cancer." In 2011, CTIC hardly makes any mention of this treatment possibility. CTIC has schizophrenically attempted to apply the drug to ovarian cancer, esophageal cancer, brain cancer, and head and neck cancer, and has yet to release any compelling results.

Throughout all this time, CTIC was lauded in stock market promotional materials as having a wonder-drug:

- Seeking Alpha - Cell Therapeutics Reemerging (4/11/2009)

- Stock Blog Hub - Cell Therapeutics Incorporated – Bull of the Day (10/13/11)

- Seeking Alpha - Cell Therapeutics: European Revenue Opportunity Could Represent a Turning Point (9/28/2012)

- Hot Penny Stocks Online - Cell Therapeutics, Inc. has Four FDA clinical trial updates December 31st 2012! (11/30/2012)

- Penny Stock Profiler Report

Chief Executive Officer James A. Bianco

It seemed like awkward timing when, on August 30 of this year, James Bianco told the Puget Sound Business Journal, "This is a great time for [CTIC], despite what the stock price may be and despite what's going on in the world economy." With the Socius deal underway, it was such a great time for CTIC that Mr. Bianco sold 50,000 shares of his own stock the very next day. Perhaps the Terren Peizer playbook was not specific enough: when you're CEO, you're not supposed to run a pump and dump scheme on your own company's stock.

In 2011 alone, CTIC paid Mr. Bianco over $4,500,000, according to regulatory filings. During the course of his career, Mr. Bianco has received over $35.8 million in compensation. Since 2009, he has received over $14 million in stock awards, making him the largest individual shareholder in the company. Indeed, CTIC's board has awarded substantial amounts of stock to Mr. Bianco. This insulates him from the dilution that ordinary shareholders suffer when the company enters into toxic and dilutive PIPE deals like the one with Socius Capital.

CTIC also pays Mr. Bianco's life insurance premiums, health club dues, and tens of thousands of dollars for "family members' travel on commercial aircraft." CTIC offers no valid corporate reason why it is in CTIC shareholders' interests for well-compensated executives' "family members" to travel at shareholders' expense. In 2011, the company paid $169,593 in "executive health benefits," also according to regulatory filings. We challenge the company to explain how Mr. Bianco's "executive health benefits" alone are justifiably over three times the median household income in America.

By contrast, Pfizer Inc. (NYSE:PFE) shareholders paid Chief Exectuvie Officer Ian Read only five times that amount for $10 billion in net income, and Novartis AG (NYSE:NVS) shareholders paid Chief Executive Officer Joseph Jimenez only three times Mr. Bianco's salary for net revenues of around $9 billion.

The red icons in the table below represent Mr. Bianco's sales of CTIC stock over the course of the past year alone. The green icons do not represent Mr. Bianco purchasing stock; rather, they represent CTIC's board granting Mr. Bianco additional stock and options. For example, according to a regulatory filing, on December 31, of last year, Mr. Bianco forfeited 2,121,821 shares of restricted stock because the "performance-based vesting conditions were not satisfied." Yet, three days later, CTIC granted Mr. Bianco a "bonus" of 4,039,843 shares upon the achievement of certain performance goals that include "market capitalization and other goals."

"If It's Good Enough to be Illegal, I Want Some"

In response to the Enron and WorldCom scandals, Congress enacted the Sarbanes-Oxley Act, which prohibited public companies from making loans to executives. The legislation was introduced in the U.S. House of Representatives in February 2002, and signed into law at the end of July 2002. So in April 2002, before it became illegal, James Bianco borrowed $3,500,000 from CTIC at a 4.55% interest rate. At the time, this was a discount to the Prime Rate.

The loan was announced less than two weeks after the company's audited annual report highlighted a net loss of over $80,000,000. The Seattle Times noted the irregularity of a company with negative cash flow making such a large loan to an executive. Indeed, it is likely that CTIC's cost of capital was higher than the interest rate it earned on the loan to Mr. Bianco.

A Subprime CEO? Bianco Defaults on Loan from Bank of CTIC

Did Mr. Bianco induce the CTIC board of directors to give him the loan because a bank was unwilling to take credit risk on him? CTIC's foray into financial services also ended almost as poorly as its drug development business. The company buried a disclosure in its 2004 proxy statement that Mr. Bianco had informed the board that he could not repay the loan by the date he had promised. Perhaps Mr. Bianco knew that he could default with impunity since he had a good relationship with the CEO of the lending institution.

The company did not disclose taking any action upon the default, such as garnishing Mr. Bianco's paycheck or seizing collateral. While the company eventually disclosed that the loan was repaid, it is not clear whether Mr. Bianco paid a penalty or 'default' interest rate, as would be common and appropriate.

Jail Cell Therapeutics

While serving as Chief Executive Officer and a member of the Board of CTIC, James A. Bianco examined a cell of a different genre after being arrested by the Washington State Patrol. Neither Mr. Bianco nor CTIC disclosed the arrest.

While on routine patrol, a police officer in a marked patrol car came behind Mr. Bianco's silver Porsche 911. According to the police report, "the vehicle slowed to 30-35 mph in a 60 [mph] zone. The Porsche then took the exit ramp. The vehicle slowed to 25 mph going up the ramp. The Porsche then swerved to the left, crossing over the yellow fog line. It then swerved right touching the lane divider. … The Porsche then swerved back to the left, crossing the fog line, near the top of the exit ramp."

After pulling Mr. Bianco over, the officer wrote that he "immediately smelled the odor of intoxicants coming from the vehicle." The officer continued, "As [Mr. Bianco] spoke to me I could smell the odor of intoxicants coming from his breath. [He] had blood-shot/watery eyes." The police reported that CTIC's chief executive was so wasted that "the second time [Mr. Bianco] stepped sideways at beginning of walk and turn instruction phrase, [Mr. Bianco] stated, 'I can't event do this S, making an S sound at the end of his sentence. I asked him 'What did you say?' [Mr. Bianco] just smiled and said, 'nothing.'"

Interestingly, Mr. Bianco told the officer "he had several SPD officers on his payroll..." The employment of Seattle Police Department officers does not appear in any of CTIC's regulatory filings.

While some may dismiss an arrest for driving under the influence as "minor," the circumstances of Mr. Bianco's arrest are another example of extremely poor judgment, something that today is axiomatic for company investors. CTIC's demise at Mr. Bianco's helm may have been foreseeable had he been forthright in taking responsibility for his arrest, and perhaps even apologizing for the lapse in judgment. Mr. Bianco's is, of course, always welcome to do so.

CTIC Joins the Club

Mr. Bianco is a high flyer. Local press in Seattle caught on to CTIC's lease of a G-4 jet. According to Puget Sound Business Journal's article, Mr. Bianco first attempted to justify the $1.9 million annual expenditure by first blaming it on the 9/11 terrorist attacks, which caused long security lines. He supplemented that compelling explanation by arguing that it helped with "extensive road shows to meet investors," and lastly that CTIC got the plane at "a very attractive rate..."

Corporate Governance

According to regulatory filings, in 2010, company shareholders filed lawsuits in Federal court alleging that CTIC and both of the Bianco brothers violated Federal securities laws by making false and misleading statements related to the FDA approval process for one of the company's drugs. CTIC and the Bianco brothers attempted to have the case dismissed, and failed. CTIC's directors' and officers' insurance carriers paid $19,000,000 into a settlement fund.

Also according to regulatory filings, in 2010, CTIC investors filed another series of lawsuits against the company, the Bianco brothers, and other directors and officers, alleging that the defendants breached their fiduciary duties by making, or failing to prevent the issuance of, certain alleged false and misleading statements related to the FDA approval process for one of the company's drugs. According to CTIC's most recent 10-Q, filed on November 1, 2012, covering the period ended September 30, 2012, the "court has set a trial date of December 3, 2012 for the shareholder derivative action."

However, according to court records, the case settled five calendar days after the 10-Q filing, but CTIC has not disclosed that fact. That is perhaps because the terms of the settlement are not flattering for CTIC's management or its board. The settlement prompts "corporate governance reforms that directly address the alleged management and board-level breaches of duty[,] and oversight lapses Plaintiffs contend led [CTIC] to breach FDA-approved clinical trial protocols for pixantrone (a non-Hodgkin's lymphoma treatment), and to mislead shareholders regarding those facts and the prospects for FDA approval."

Notably, the settlement also addresses "insider trading" by CTIC officers and directors. "The [settlement mandated corporate] reforms directly respond to Plaintiffs' allegations that certain officers and directors of [CTIC] engaged in improper insider trading[,] by expanding the responsibilities and duties of the Company's Trading Compliance Officer to require monitoring and review of insider stock sales, as well as mandatory pre-approval of Section 16 officer and director sales.... Taken together, these reforms substantially reduce the risk that CTI will be tainted by improper insider sales in the future...".

No Chief Financial Officer: A Twenty Year CTIC Tradition of Malignant Consanguinity

Disclosure problems costing $19,000,000 usually don't happen by accident. CTIC's website reveals that the company has no Chief Financial Officer. Louis Bianco, chief executive officer James Bianco's brother, serves as the company's "Executive Vice President - Finance and Administration," a position he has held since February 1992, despite CTIC's serious problems since then. In 2009, for example, Louis' compensation package was $4,600,000, according to company filings. In 2011, the board gave Louis a $50,000 bonus to "recognize [his] 20 years of continuous service with the Company since its inception."

The Auditor

The role of a public company auditor is to protect the interests of investors and further the public interest in the preparation of informative, accurate and independent audit reports. In other words, the auditor is the bulwark against poor disclosure by public companies. CTIC chose Marcum LLP, a firm that, according to regulatory filings, had offices on the East Coast of the US, and in offshore havens including Grand Cayman, Cayman Islands, British West Indies. None of its offices were near CTIC headquarters in Seattle.

The Public Company Accounting Oversight Board, known as the PCAOB, is an organization established by Congress to oversee the audits of public companies. In its periodic inspection of Marcum's audits of its client companies, the PCAOB found "what it considered to be audit deficiencies … of such significance that it appeared to the inspection team that [Marcum] did not obtain sufficient competent evidential matter to support its opinion on the issuer's financial statements."

According to CTIC's annual report, filed with the SEC, its principal accountants billed $590,000 in 2011 and $450,000 in 2010 for their services. With such significant fees, it is worth asking why CTIC didn't opt for a more reputable auditor. Perhaps the Bianco brothers didn't want to invite a party-pooper.

The Fox Guards the Henhouse: CTIC's Board Chairman Has a Fake Ph.D.

Executives and board members of credible big pharma companies such as Bristol-Myers Squibb (NYSE:BMY), Novartis (NYSE:NVS), and Merck (NYSE:MRK) hold advanced degrees from reputable universities. One can't blame CTIC for wanting to fit in. CTIC boasts that its current Chairman, "Dr." Phillip M. Nudelman, "holds an M.B.A. and a Ph.D. in health systems management from Pacific Western University." The company makes a point of highlighting his credentials in its filings with the SEC, and on its website. But CTIC seemingly could not find someone with real credentials to put their reputation on the line. Indeed, what the company hasn't said is that the "university" that issued Mr. Nudelman's "degrees" required no classes or dissertation; it required a signed check.

Pacific Western University was a Hawaii based diploma mill that allowed students to purchase a wide variety of fake "degrees" through a network of websites. They offered fake Ph.D. degrees in a wide variety of fields, including health care. It was eventually shut down by the state. This school is not to be confused California Miramar University (f/k/a Pacific Western University), which is a recently ACICS/DETC accredited for-profit distance education school. However, it does not offer Ph.D. degrees in any field.

Importantly, Pacific Western was not accredited in 1996 when the company highlighted Mr. Nudelman's academic history in some of its earliest filings. The company chose instead to neglect that fact.

In 1997, while Mr. Nudelman was a CTIC director, the Seattle Times published an article describing how Mr. Nudelman misled his former employer when a national television program called his alma mater into question. We were unable to find any disclosure of this event in company filings. Despite this public record of the invalidity of Mr. Nudelman's degrees, the company continued to refer to him through the years as a Ph.D. like any other, even after the USGAO classified Pacific Western as a diploma mill in 2004, and after Pacific Western went under in 2006.

A few months ago, Scott Thompson resigned as CEO of Yahoo (NASDAQ: YHOO) following revelations that he had misrepresented his academic credentials. Patti Hart, the Yahoo board member in charge of the botched vetting process that resulted in the hiring of Mr. Thompson, also stepped down.

Following these events, many public companies took the opportunity to double-check the credentials of their top brass. It is a violation of Federal securities law for companies to make a statement that is "false or misleading with respect to any material fact, or which omits to state any material fact necessary in order to make the statements therein not false or misleading." CTIC should also be concerned by a New Jersey law that states "a person or other legal entity shall not use, or attempt to use, in connection with any business … any academic degree or certification of degree ... including … a transcript of course work, which has been fraudulently issued, obtained, forged or altered. A person shall not, with intent to deceive, falsely represent himself as having received any such degree or credential."

Perhaps having a weak board chairman is exactly what CTIC management wants. In 2002, when the board approved Mr. Bianco's loan, Mr. Nudelman was on the executive and audit committees. In 2004, when Mr. Bianco could not repay his loan, Nudelman was on the nominating and governance committee, and on the audit committee placed in charge of insuring the loan's repayment. Professor Joe Hadzima, a senior lecturer at MIT's Sloan School of Management and an expert on corporate governance, referring to CTIC, told the Seattle Times, "The board is there to represent shareholder interests. … I wouldn't want to be on this board."

For Mr. Nudelman, sweetheart deals are a two-way street. According to a disclosure buried on page 150 of CTIC's annual report, CTIC thought it was appropriate to make a "charitable donation" to an organization where Mr. Nudelman's son, Mark, "serves as the President and Chief Executive Officer." Mark is highly paid, drawing a salary of over a quarter million dollars, according to a Better Business Bureau report. Notably, the organization's "fund raising costs were 35% of related contributions," more than double those of reputable charities like the American Red Cross.

A $325,000 Bonus for an Award-Winning CEO

James A. Bianco was nominated for, and won, TheStreet.com's contest for "Who Is the Worst Biotech CEO of 2012?" Senior columnist Adam Feuerstein notes that CTIC's performance this year is "pathetic and underscores how much investors loathe Bianco's toxic reign at Cell Therapeutics." He explains that Mr. Bianco won because, "TheStreet's biotechnology readers are (dis)honoring Bianco for a lifetime of investor bamboozlement and self-enrichment. The numbers that define Bianco's career as chief executive of Cell Therapeutics are stunning: Total losses of more than $1.7 billion, a 99.99999999% drop in the value of company shares and total compensation for him and his hand-picked team of executive cronies in the tens of millions of dollars."

The CTIC board sees things differently. On December 7th, the same day that TheStreet.com presented this prestigious award to Mr. Bianco, CTIC announced that the board had awarded "year-end cash incentive awards" to Mr. Bianco and his brother in the amounts of $325,000 and $110,500, respectively. The company's regulatory disclosure did not explain how the board determined that bonuses of any kind were appropriate, or how much the company paid out to non-senior executives.

Mr. Feuerstein has called on Mr. Bianco to resign. We agree.

* * *

Capital IQ Abstract for CTIC

| Registration Filed | Registration Effective | Offer Date | Primary Transaction Feature(s) | Securities Issued | Size ($mm) |

| 10/4/2012 | 8/29/2012 | 10/5/2012 | Fixed-Income Offering | Preferred Stock | $60.00 |

| 5/29/2012 | 11/1/2011 | 5/29/2012 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $40.00 |

| 10/25/2011 | 11/23/2011 | 12/8/2011 | Fixed-Income Offering | Preferred Stock | $20.00 |

| 6/29/2011 | - | 7/5/2011 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $30.00 |

| 4/27/2011 | - | 5/3/2011 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $15.97 |

| 2/15/2011 | - | 2/15/2011 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $24.96 |

| 1/12/2011 | - | 1/31/2011 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $25.00 |

| 5/23/2010 | - | 5/23/2010 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $21.00 |

| 3/30/2010 | - | 4/6/2010 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $20.00 |

| 1/13/2010 | - | 1/19/2010 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $30.00 |

| 8/19/2009 | - | 8/21/2009 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $30.00 |

| 7/22/2009 | 4/6/2009 | 7/22/2009 | Follow-on Equity Offering | Common Stock | $38.13 |

| 5/11/2009 | - | 5/11/2009 | Follow-on Equity Offering | Common Stock, Equity Warrant | $20.00 |

| 9/5/2008 | 9/19/2008 | 12/4/2008 | Fixed-Income Offering | Corporate Bond/Note | $32.65 |

| 4/29/2008 | - | 4/30/2008 | Fixed-Income Offering | Corporate Bond/Note, Equity Warrant, Preferred Stock | $59.33 |

| 3/28/2008 | 4/23/2008 | 4/30/2008 | Composite Units Offering | Corporate Bond/Note, Equity Warrant, Preferred Stock, Unspecified Unit | $59.33 |

| 3/28/2008 | 4/23/2008 | 7/23/2008 | Fixed-Income Offering | Corporate Bond/Note | $22.25 |

| 3/3/2008 | - | 3/4/2008 | Fixed-Income Offering | Corporate Bond/Note, Equity Warrant | $51.66 |

| 12/20/2007 | - | 12/21/2007 | Follow-on Equity Offering | Common Stock, Equity Warrant | $7.01 |

| 11/29/2007 | - | 12/3/2007 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $6.50 |

| 7/25/2007 | - | 7/30/2007 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $20.25 |

| 6/1/2007 | 6/15/2007 | 1/14/2008 | Follow-on Equity Offering | Common Stock | $1.27 |

| 4/11/2007 | - | 4/16/2007 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $37.20 |

| 2/8/2007 | - | 2/14/2007 | Fixed-Income Offering | Equity Warrant, Preferred Stock | $20.00 |

| 9/18/2006 | - | 9/20/2006 | Follow-on Equity Offering | Common Stock, Equity Warrant | $40.00 |

| 4/24/2006 | - | 4/27/2006 | Fixed-Income Offering | Corporate Bond/Note | $31.83 |

| 2/3/2006 | 9/20/2006 | 2/13/2007 | Fixed-Income Offering | Preferred Stock | $2.36 |

| 10/31/2005 | - | 11/4/2005 | Fixed-Income Offering | Corporate Bond/Note | $78.72 |

| 12/20/2004 | - | 12/22/2004 | Follow-on Equity Offering | Common Stock | $18.36 |

| 2/11/2004 | 3/22/2004 | 7/28/2004 | Follow-on Equity Offering | Common Stock | $42.75 |

| 2/11/2004 | 7/13/2004 | 12/21/2004 | Follow-on Equity Offering | Common Stock | $2.00 |

| 6/17/2003 | - | 6/23/2003 | Fixed-Income Offering | Corporate Bond/Note | $75.00 |

| 11/19/2002 | 12/17/2002 | 12/17/2002 | Fixed-Income Offering | Corporate Bond/Note | $102.90 |

| 6/4/2001 | - | 6/13/2001 | Fixed-Income Offering | Corporate Bond/Note | $150.00 |

| 7/12/2000 | 9/18/2000 | 9/21/2000 | Follow-on Equity Offering | Common Stock | $118.96 |

| 9/26/1997 | 10/21/1997 | 10/22/1997 | Follow-on Equity Offering | Common Stock | $36.80 |

| 1/31/1997 | 3/18/1997 | 3/21/1997 | IPO | Common Stock | $30.00 |

Historical Volatility of CTIC

By viewing this material, you agree to the following Terms of Service. You agree that use of Tourbillon Research’s research is at your own risk. In no event will you hold Tourbillon Research or any affiliated party liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence before making any investment decision with respect to securities covered herein. You represent to Tourbillon Research that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this site. You further agree that you will not communicate the contents of this report to any other person unless that person has agreed to be bound by these same terms of service. If you download or receive the contents of this report as an agent for any other person, you are binding your principal to these same Terms of Service.

You should assume that as of the publication date of our reports and research, Tourbillon Research (possibly along with or through its members, partners, affiliates, employees, and/or consultants) and/or investors and/or their clients and/or investors (the “Tourbillon Parties”) has a short position in all stocks (and/or options, swaps, and other derivatives related to the stock) and bonds covered herein, and therefore stands to realize significant gains in the event that the price of any declines. The Tourbillon Parties intend to continue transacting in the securities of issuers covered on this site for an indefinite period after Tourbillon Research’s first report, and the Tourbillon Parties may be long, short, or neutral at any time hereafter regardless of Tourbillon Research’s initial recommendation.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall Tourbillon Research offer, sell or buy any security to or from any person through this site or reports on this site.

Tourbillon Research is not registered as an investment advisor in any jurisdiction.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Tourbillon Research’s research and reports express Tourbillon Research’s opinions, which Tourbillon Research has based upon generally available information, field research, inferences and/or deductions through a due diligence and analytical process. To the best of Tourbillon Research’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources Tourbillon Research believes to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. Tourbillon Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any report on this site contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and Tourbillon Research does not undertake to update or supplement any reports or any of the information, analysis and opinion contained in them.

You acknowledge and agree that any dispute arising from your use of this report and / or the Tourbillon Research website or viewing the material hereon shall be governed by the laws of the State of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law.

The failure of Tourbillon Research to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision.

You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

You should assume that as of the publication date of our reports and research, Tourbillon Research (possibly along with or through its members, partners, affiliates, employees, and/or consultants) and/or investors and/or their clients and/or investors (the “Tourbillon Parties”) has a short position in all stocks (and/or options, swaps, and other derivatives related to the stock) and bonds covered herein, and therefore stands to realize significant gains in the event that the price of any declines. The Tourbillon Parties intend to continue transacting in the securities of issuers covered on this site for an indefinite period after Tourbillon Research’s first report, and the Tourbillon Parties may be long, short, or neutral at any time hereafter regardless of Tourbillon Research’s initial recommendation.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall Tourbillon Research offer, sell or buy any security to or from any person through this site or reports on this site.

Tourbillon Research is not registered as an investment advisor in any jurisdiction.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Tourbillon Research’s research and reports express Tourbillon Research’s opinions, which Tourbillon Research has based upon generally available information, field research, inferences and/or deductions through a due diligence and analytical process. To the best of Tourbillon Research’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources Tourbillon Research believes to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. Tourbillon Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any report on this site contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and Tourbillon Research does not undertake to update or supplement any reports or any of the information, analysis and opinion contained in them.

You acknowledge and agree that any dispute arising from your use of this report and / or the Tourbillon Research website or viewing the material hereon shall be governed by the laws of the State of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the superior courts located within the State of New York and waive your right to any other jurisdiction or applicable law.

The failure of Tourbillon Research to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision.

You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

No comments:

Post a Comment